Nonmetallic Minerals and Quarry Resources Imported Four percent 4 based on the value used by the Bureau of Customs BOC in determining tariff and. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Excise Tax In The United States Wikipedia

Excise Tax In The United States Wikipedia

The excise tax shall be paid within the time prescribed according proc307 Sub-Article2.

Excise tax rate. Use location code when completing form 84-0001B for entity transfer. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax. The following tables show local tax rates and the combined rate including the state tax rate of 128 effective in all locations.

Amounts paid for tanning services are subject to a 10 percent excise tax under the Affordable Care Act. 24478 per 1000 cigarettes plus 165 of. Excise Taxes on Retirement Accounts Excess contributions to an IRA not corrected by the deadline pay a 6 excise tax.

They also provide an overview of the rates of duty applicable for various licences. 16 rows DISTILLED SPIRITS Reduced Tax Rates on Domestic Removals or Imports 2018 to. Base of Computation of Excise Tax.

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. Sports wagering like wagering in general is subject to federal excise taxes regardless of whether the activity is allowed by the state. It also provides the historical excise duty rates in effect for.

This page provides the rates of all excise duty imposed under the Excise Act 2001 on spirits wine tobacco products and cannabis products and under the Excise Act on beer. In respect of goods produced locally the cost of production. 50 per cent on carbonated drinks.

Tax type code Rate of Excise Duty from 16 November 2020 Minimum Excise Tax. This schedule is revised quarterly as needed. The excise rate is 25 per 1000 of your vehicles value.

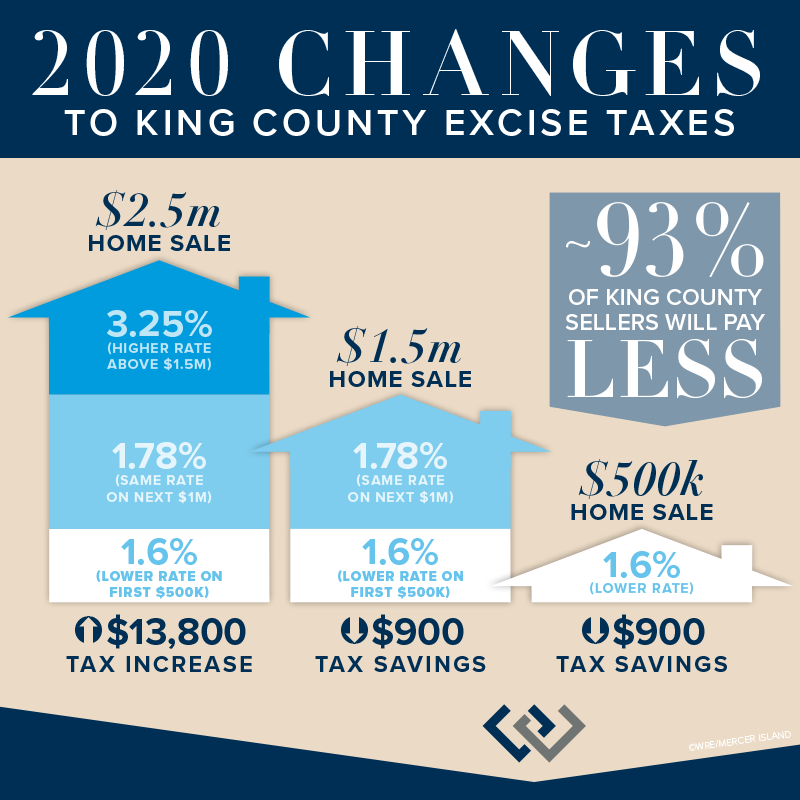

Excise taxes are also charged on some retirement account activities. Real Estate Excise Tax Rates Rates Effective December 27 2018 to December 31 2019 Please Note. A 10 tax applies to distributions from an IRA qualified plan or a 403 b.

52 of 2019 on Excise Goods Excise Tax Rates and the Methods of Calculating the Excise Price PDF 100 KB the rate of excise tax is as follows. If your vehicle is registered in Massachusetts but garaged outside of Massachusetts the Commissioner of Revenue will bill the excise. 36 rows 7 percent of taxable receipts from the first sale of adult use cannabis by a.

Unlike a sales tax an excise tax is usually a fixed amount not a percentage of the purchase price and excise taxes are only collected on the sale of specific taxable products rather then. Many people are familiar with these taxes as penalties. In respect of goods imported cost insurance and freight CIF value Payment of Excise Tax.

According to Cabinet Decision No. The following pages provide an overview of the current excise duty rates. Excise taxes are special fees collected by the government on the sale of certain products.

As a result each state may decide whether to allow sports wagering. Customs tariff Excise taxes Excise duty Softwood lumber products export charge Air travellers security change. When produced locally at the rate prescribed in the schedule.

A 6 excise tax is applied to excess individual retirement account IRA. Current rates for customs duties and tariffs and the current excise tax rates. 100 per cent on tobacco products.

Excise Tax on Indoor Tanning Services. For further information in relation to the operation of each excise duty please see the Related topics section. Four percent 4 based on the actual market value of the gross output thereof at the time of removal.

Tax Revenue Vs Excise Tax Rate 1990 2010 Download Scientific Diagram

Tax Revenue Vs Excise Tax Rate 1990 2010 Download Scientific Diagram

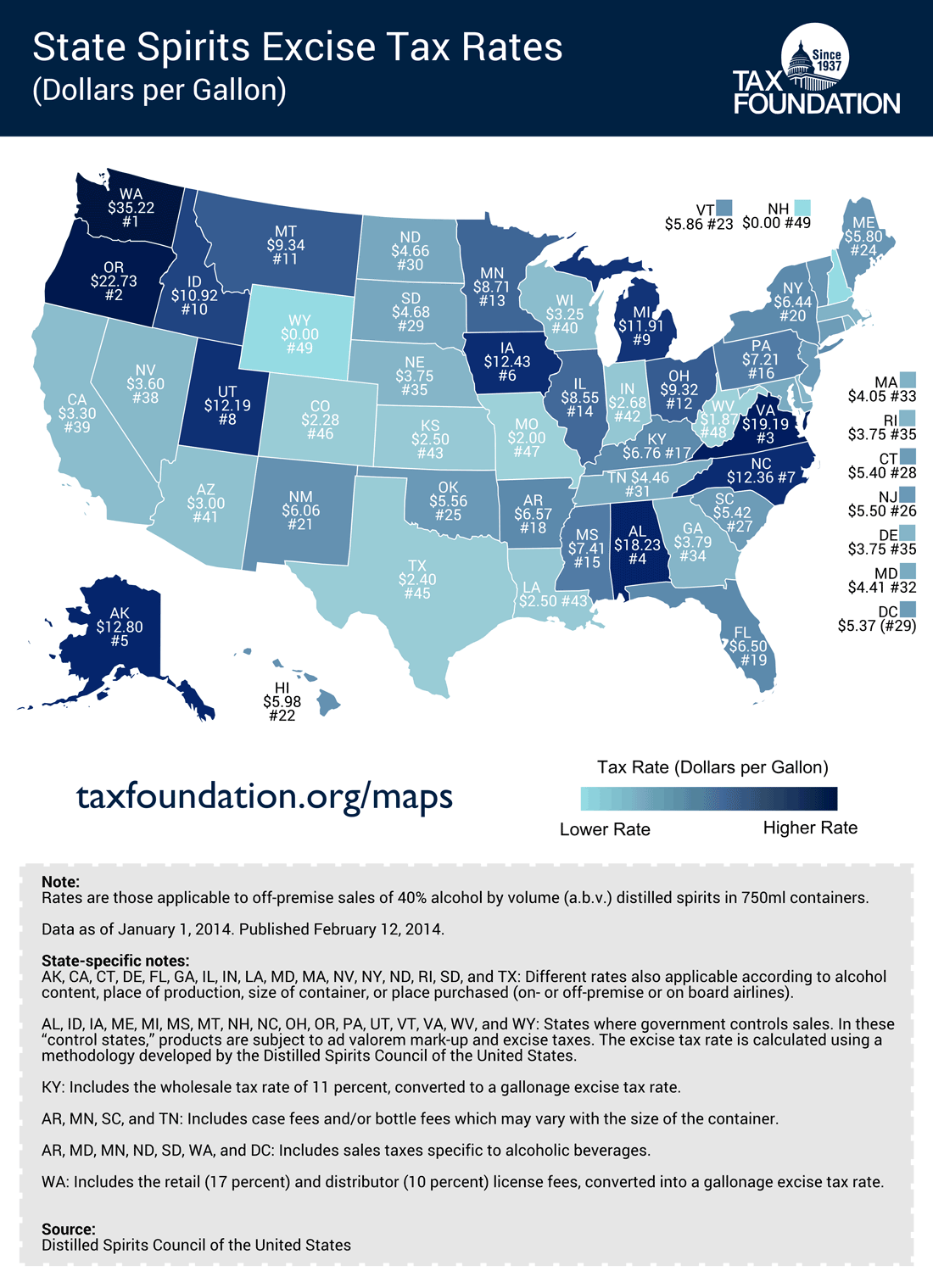

New Real Estate Excise Tax Reet Rate For 2020 Kathryn Lerner

New Real Estate Excise Tax Reet Rate For 2020 Kathryn Lerner

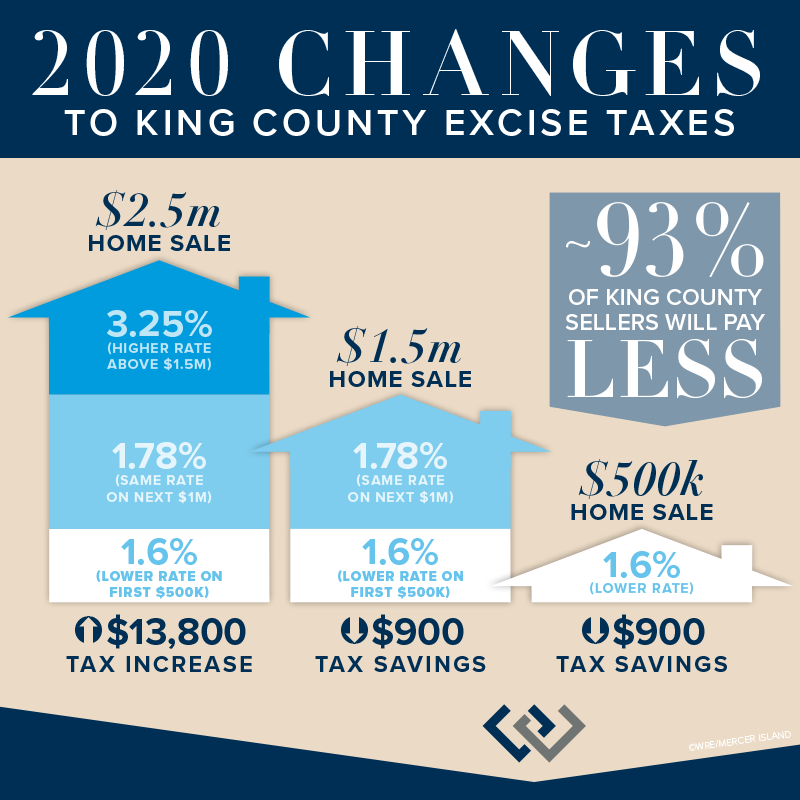

Map Spirits Excise Tax Rates By State 2014 Tax Foundation

Map Spirits Excise Tax Rates By State 2014 Tax Foundation

File Effective Federal Excise Tax Rate By Income Group 2007 Jpg Wikipedia

File Effective Federal Excise Tax Rate By Income Group 2007 Jpg Wikipedia

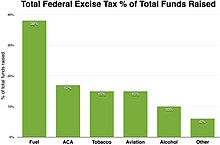

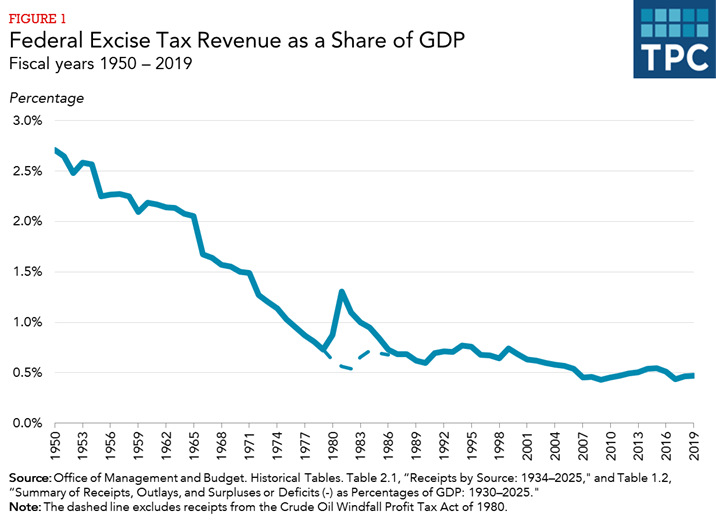

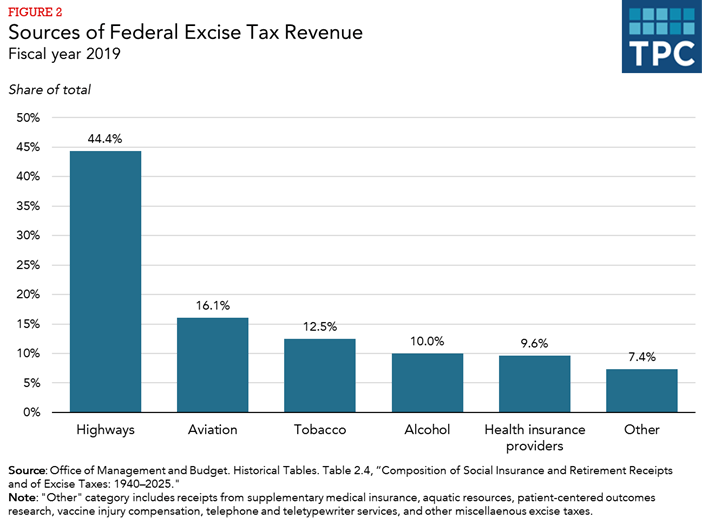

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

Laos Tax Alert Tax Department Clarifies New Excise Tax Rates For 2018

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

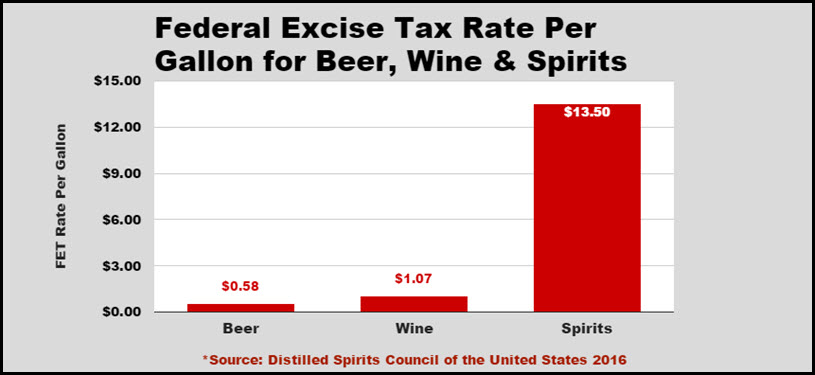

Part 1 The Distilled Spirits Federal Excise Tax Rate Is 1162 And 2228 Higher Than Wine And Beer Distillery Trail

Part 1 The Distilled Spirits Federal Excise Tax Rate Is 1162 And 2228 Higher Than Wine And Beer Distillery Trail

Structure Of Federal Excise Duty On Cigarettes Download Scientific Diagram

Structure Of Federal Excise Duty On Cigarettes Download Scientific Diagram

Petrol World Philippines New Fuel Excise Tax To Take Effect After January 15

Petrol World Philippines New Fuel Excise Tax To Take Effect After January 15

Map Wine Excise Tax Rates By State 2014 Tax Foundation

Map Wine Excise Tax Rates By State 2014 Tax Foundation

Excise Tax Rate Schedule Applied To Beverage Products Under The Excise Download Scientific Diagram

Excise Tax Rate Schedule Applied To Beverage Products Under The Excise Download Scientific Diagram

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.