This penalty cannot be more than the national average premium for a bronze plan. I imagine a few thoughts are circling through your head reading that and among them would be this has to be the dumbest financial planner alive hasnt he heard there is a global pandemic going on.

How Bad Is It If I Don T Have Health Insurance Marketwatch

How Bad Is It If I Don T Have Health Insurance Marketwatch

This fine was called the Shared Responsibility Payment.

I don t have health insurance. In a medical emergency go to a hospital emergency room. If you take good preventative care of your health its hard to see why youd really need insurance. Without an insurer to absorb some or even most of those costs the bills can.

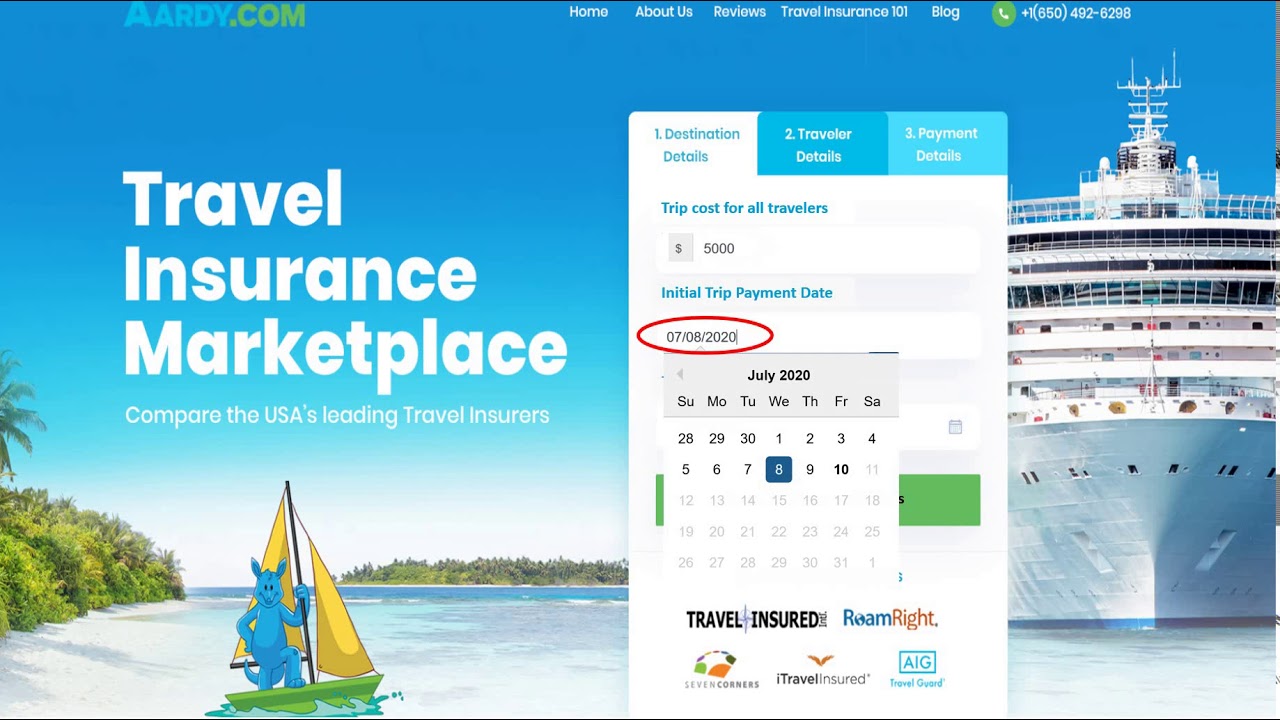

With one Marketplace application you can review lower costs based on your income compare. The maximum an individual under the age of 55 can contribute to a. When the ACA went into effect if you chose not to have health insurance you faced a fine.

If you do not purchase health insurance for 2016 you may be subject to a tax penalty. Until recently if you didnt enroll in minimum essential coverage and were not exempt from the mandate you could owe a federal tax penalty known as the shared responsibility payment. If you dont you may have to pay a fine to the state.

I dont have health insurance. If you live in a state that requires you to have health coverage and you dont have coverage or an exemption youll be charged a fee when you file your 2020 state taxes. They will not deny care or treatment.

You will pay for a policy that will not pay the major claims you incur if you have. You no longer will be penalized for not having health insurance. Before the TCJA change you were subject to a penalty if you had a lapse in health insurance for a specific amount of time.

An Advantageous Cost Structure My personal view on insurance is that one should first aim to live a life that doesnt require insurance. My children dont have health insurance. No Im not joking.

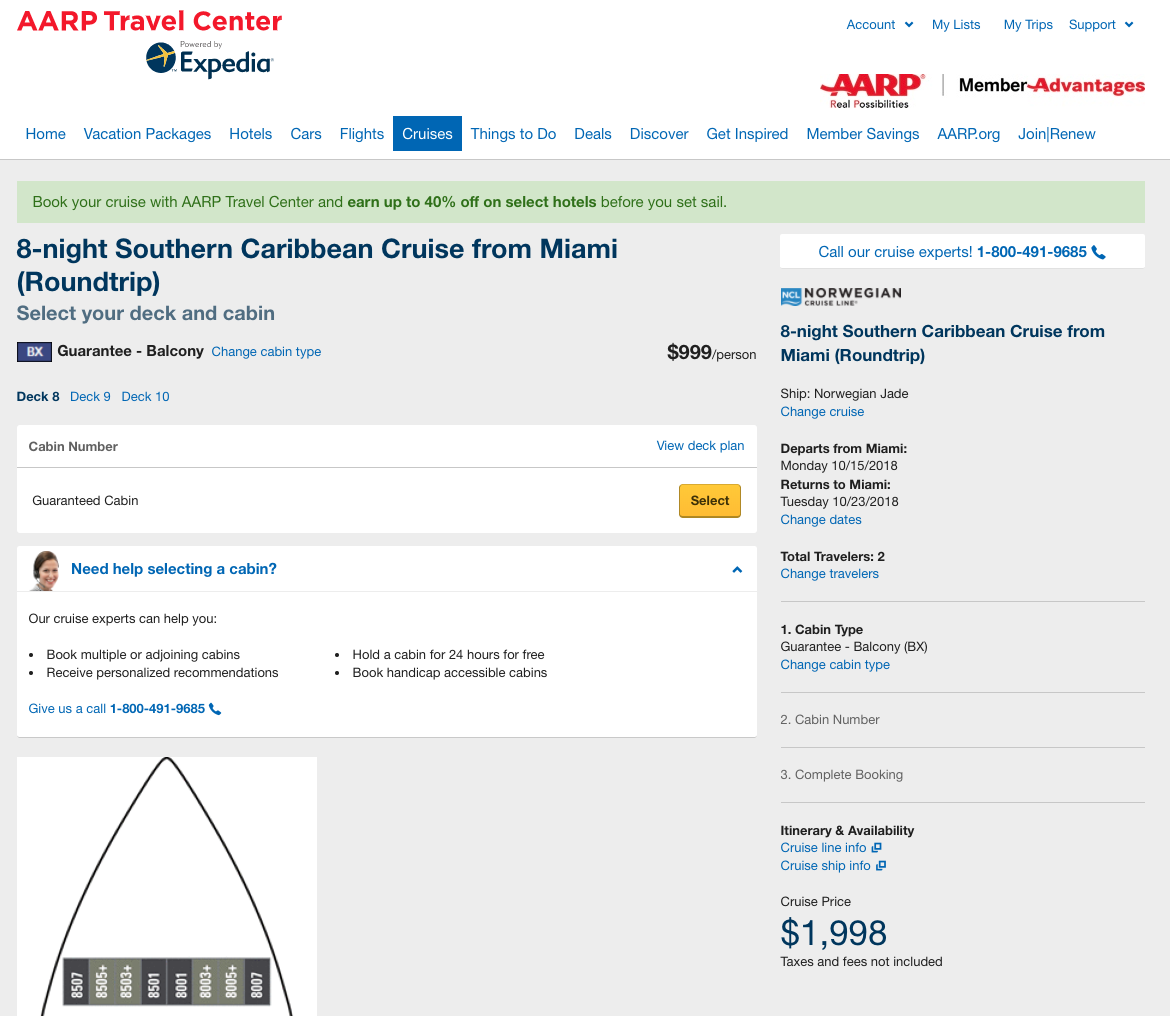

If you recently left your job got fired or got laid off you may qualify to get insurance. Youll be charged a fee when you file your 2019 state taxes. In 2018 according to a report by the US.

But Consumer Reports found the average ER bill for an uninsured patient in 2018 was 2200. For patients who dont have insurance the cost of an ER visit can vary widely depending on many different things. The maximum out-of-pocket exposure under these plans can be no more than 6350 for an individual and 12700 for a family.

As of 2019 the fine is no longer enforced by the federal government. The answer is no. It can help if you dont have coverage or if you have it but want to look at other options.

Census 85 percent of people or 275 million adults between the ages of 19-64 did not have health insurance at any point during the year. When the Affordable Care Acts ACA otherwise known as Obamacare individual mandate took effect in 2014 so did the penalty for going without health insurance. If you have the misfortune of undergoing a medical emergency without insurance it is easy to find yourself with a crippling amount of medical debt and seemingly no way out of the mess.

Qualified high deductible health insurance plans for 2014 can have a deductible starting at 1250 for individual coverage and 2500 for family coverage. This insurance option can work great for stay at home parents or someone between. You will NOT get Form 1095-A unless you or someone in your household had Marketplace coverage for all or part of 2020.

Not being required by federal law to have health insurance coverage doesnt mean you dont need it. Why have an Individual Mandate. 25 percent of your yearly filing threshold.

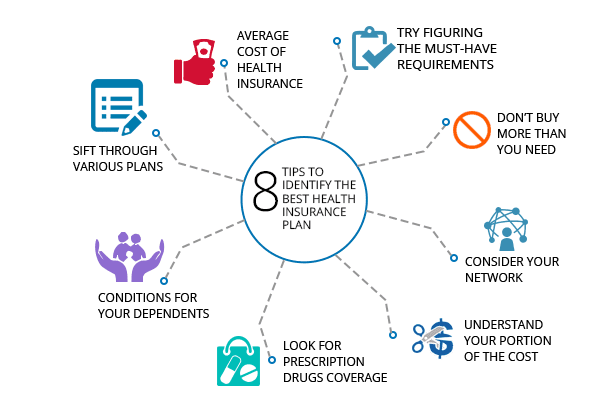

If you dont have any health insurance What are you supplementing. This penalty was designed to protect both people from skipping out on health insurance and not being able to pay off their medical expenses in the event of injury or illness. If you dont have health insurance paying for care can seem overwhelming.

I also dont have car insurance as Ive spent many years now living without a car. What Happens If I Dont Have Health Insurance. Is it cheaper to go to urgent care or ER without insurance.

The tax penalty for 2016 will be the HIGHER of the following options. For example I dont need home insurance because I never wanted to own a home. The prior tax penalty for not having health insurance in 2018 was 695 for adults and 34750 for children or 2 of your yearly income whichever amount is more.

These states have an individual mandate for the same reason the ACA originally did. If you need care it is important that you get medical care before you get worse. If you dont have health insurance take time to.

7 Options If You Dont Have Health Insurance From an Employer 1. My wife doesnt have health insurance. A Health Insurance Marketplace is defined as a new way to find quality health coverage.

You wont owe a fee on your federal tax return. Check with your state or tax preparer. There are three reasons why I dont have or want health insurance.

You were required to answer questions about your healthcare coverage when you filed your tax return. However if you dont have health insurance you will be billed for all medical services which may include doctor fees hospital and medical costs and specialists payments. If you live in a state that requires you to have health coverage and you dont have coverage or an exemption.

Check with your state or tax preparer to find out if there is a fee for not having health coverage. If you live in one of the above states this means you must have health insurance coverage. Start now to get the coverage and care you need.

There are many resources available to help you.