A Certificate of Authority is a document issued by the New York State Education Department Office of the Professions which indicates their approval for a new professional service provider to open a PLLC or PC. The certificate of authority eliminates the need to incorporate a new business entity instead establishing the company as a foreign entity in New York state.

Http Chateaulamercatering Com Files Uploaded 112829 1d2d11 Retail 20cert Pdf

The certificate allows a business to collect sales tax on taxable sales.

New york state certificate of authority. Operating without a certificate of authority may result in penalties or fines. You have the right to refuse a resale certificate even if its properly completed and valid. In New York State the Certificate of Authority also known as the Certificate of Authority to Collect Sales Tax is the Sales Tax ID number the state requires a business to use when collecting sales tax.

An out-of-state Limited Liability Company can register for a Certificate of Authority in New York State. If I am required to register for New York State sales and use tax purposes may I begin business without a New York State Certificate of Authority. What is a resale certificate and who can use one.

Businesses should consult with an attorney to learn more about legal structures. A foreign authorized corporation that has been dissolved merged out of existence or had its authority to conduct its business terminated or canceled in its jurisdiction of incorporation must file a Certificate of Termination of Existence with the New York Department of State. In that case you should charge the buyer sales tax.

Requests for a Sales Tax ID number must go through the New York State NYS Department of Taxation and Finance. Businesses that sell tangible personal property or taxable services in New York State need a Certificate of Authority. The Certificate of Authority gives you the right to collect tax on your taxable sales and to issue and accept most New York State sales tax exemption certificates.

An officer of the corporation asserts that the corporation has authorized its Vice President to act with regard to a real estate transaction. Most of these rules apply to businesses with a physical presence in New York State. Businesses that are incorporated in another state will typically apply for a New York certificate of authority.

This presence can include headquarters a. Generally the seller collects the tax from the purchaser and remits it to New. You may also need the certificate of authority to register for other business licenses and to register with banks and vendors.

Your business locations if you have multiple locations in New York youll need to file for a New York sales tax permit for each location Register for a Certificate of Authority online through the Business Express Registration section of the New York Department of Revenue and Finance. You are considered a vendor and must register with the Tax Department if you sell tangible personal property or taxable services such as personal property repairmaintenance and meet any of these conditions. The Sales Tax Certificate of Authority is sometimes referred to as a sellers permit sales tax number or sales tax license.

If you will be making sales in New York State that are subject to sales tax you must register with the Tax Department and obtain a Certificate of Authority online at New York Business Express. If you will be making sales in New York State that are subject to sales tax you must register with the Tax Department and obtain a Certificate of Authority. Doing business in New York without having this certificate can result in fines or other penalties.

This permit is also known as a wholesale license a resale license a sales permit and a resale certificate. A Certificate of Authority is required for any business selling tangible goods in New York. The certificate comes from the New York State Department of Taxation and Finance DTF.

How do I obtain a Certificate of Good Standing also known as a Certificate. Before a business starts selling products or providing taxable services they must first get a New York Sales Tax Certificate of Authority from the New York Department of Taxation and Finance. A certificate which includes a termination statement under seal of the Secretary of State or equivalent official of the corporations jurisdiction must be filed with the New York Department of State.

Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Companies register with the New York State Department of State NYSDOS. If your corporation is a professional corporation in New York a Certificate of Good Standing from the appropriate Appellate Division or a Certificate of Authority Form PLS709 under seal from the New York State Department of Education Division of Professional Licensing Services Corporations Unit 89 Washington Avenue 2nd Floor Albany NY.

When a foreign limited liability company that has received a certificate of authority is dissolved or its authority to conduct its business or existence is otherwise terminated or canceled in the jurisdiction of its formation or when such foreign limited liability company is merged into or consolidated with another foreign limited liability company a a certificate of the secretary of state or official performing the. Note the Certificate of Authority were referring to is also known as a PLS709 not a Certificate of Authority to collect sales tax. All business entities that make taxable sales in New York State must register with the NY Department of Taxation and Finance and acquire a Certificate of Authority to collect sales tax.

Why Do Businesses Filing for a New York State Certificate of Authority. Exemption certificates from other states arent valid in New York and those buyers will have to pay sales tax. Businesses will need to provide proof of registration in their home state or country.

NYS sales tax Certificate of Authority DTF-17. In New York State without possessing a valid Cettificate of Authority you will be subject to penalty of up to 500 for the first day on which you make a sale or purchase and up. The buyer must have a Certificate of Authority unless they are from another state.

Ny Business Owners Pay 50 Now Or Be Sut Down By Sales Tax Authority

Http Documents Dps Ny Gov Public Common Viewdoc Aspx Docrefid 4f07c4a5 D280 4a6a 9cba F2f7adefcab3

Https Www Victoriantradingwholesale Com Pdf Ny 20taxforms Pdf

Free New York Certificate Of Incorporation Not For Profit Corporation Form Dos 1511 F

Free New York Certificate Of Incorporation Not For Profit Corporation Form Dos 1511 F

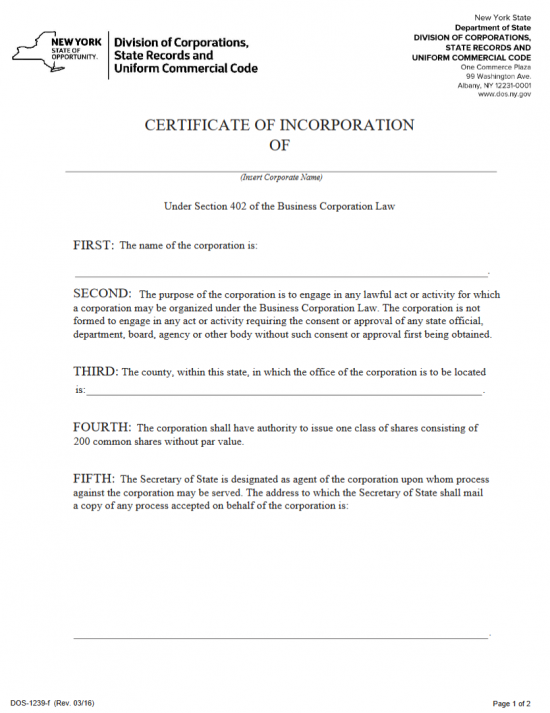

Free New York Certificate Of Incorporation Business Corporation Form Dos 1239 F

Free New York Certificate Of Incorporation Business Corporation Form Dos 1239 F

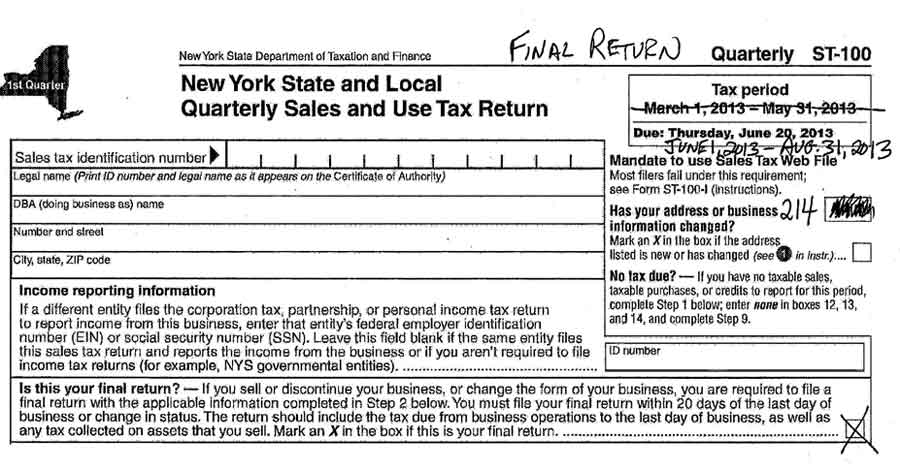

Filing A Final Sales Tax Return

Filing A Final Sales Tax Return

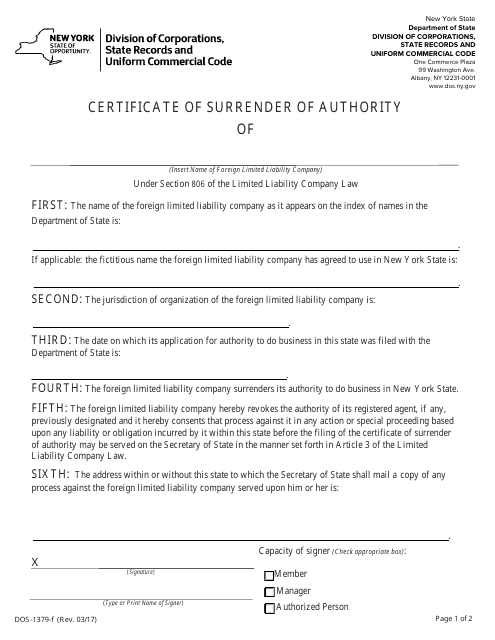

Form Dos 1379 F Download Fillable Pdf Or Fill Online Certificate Of Surrender Of Authority New York Templateroller

Form Dos 1379 F Download Fillable Pdf Or Fill Online Certificate Of Surrender Of Authority New York Templateroller

New York Certificate Of Authority Foreign New York Corporation

New York Department Of Taxation And Finance Certificate Of Authority Financeviewer

Restaurant Total Services Design Your Consultant In All Of Your Business Needs To Comply With The Nyc Enforcement Agencies

New York Atap Certificate Sample Seller Server Classes

New York Atap Certificate Sample Seller Server Classes

How To File A Foreign Corporation In New York Application For Authority Start Your Small Business Today

How To File A Foreign Corporation In New York Application For Authority Start Your Small Business Today

New York Seller S Permit Ny Business Tax Permit Fast Filings

New York Seller S Permit Ny Business Tax Permit Fast Filings

How To File A Foreign Llc In New York Application For Authority Start Your Small Business Today

How To File A Foreign Llc In New York Application For Authority Start Your Small Business Today

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.