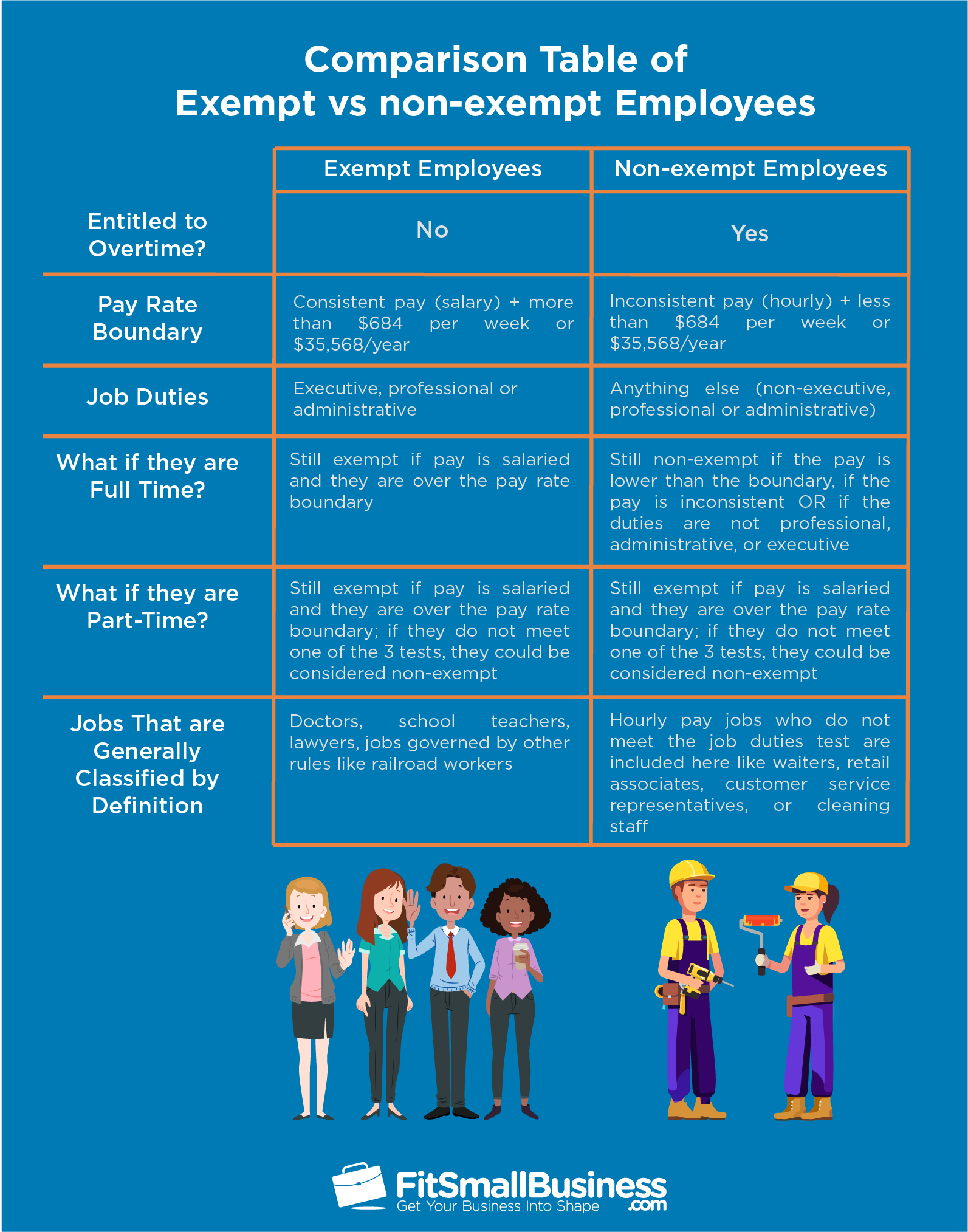

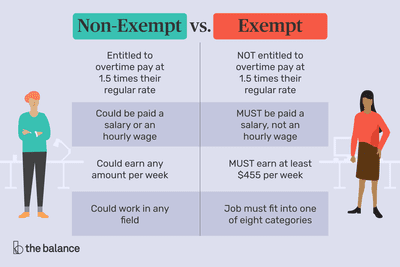

An exempt employee is not paid overtime wages for hours worked over 40 in a workweek. EXEMPT adjective The adjective EXEMPT has 2 senses.

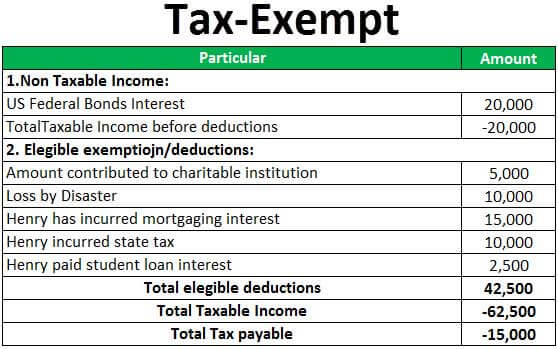

Tax Exempt Meaning Examples What Is Tax Exemption

Tax Exempt Meaning Examples What Is Tax Exemption

Taxes to which others or other things are subject.

What does it mean to be exempt. Here is the criteria for exempt employees. What Exactly is an Exempt Employee. An exempt employee is not eligible to receive overtime pay and is excluded from minimum wage requirements.

One of the main differences between exempt employees and non-exempt employees is that exempt employees receive a salary for the work they perform while non-exempt employees earn an hourly wage. This distinction is based on certain job factors as stated in the Fair Labor Standards Act FLSA. Exempt means that something or someone is either apart from or not required to participate in something that others have to do.

Employees who are exempt from withholding are exempt from federal withholding for income tax. What is an exempt employee. Being tax exempt means that some or all of a transaction entity or persons income or business is free from federal state or local tax.

EXEMPT used as an adjective is rare. A salary basis means that the employee receives a predetermined salary regardless of the number of hours they work. An exempt employee is an employee who does not receive overtime pay or qualify for the minimum wage.

To exempt a student from an examination. Tax-exempt refers to income or transactions that are free from tax at the federal state or local level. Claiming tax exempt status means that no federal income taxes will be withheld from your paycheck.

This may be the case if you were entitled to a full refund of all the federal taxes you paid last year and thus expect a full refund of all the federal taxes that would be withheld from your paychecks this year. Currently that is 455 a week or 23600 per year. An exempt employee is someone who cannot receive overtime pay.

To have exempt employee status there are three exempt employee requirements that must be met. What does exempt mean. When an employee begins working for you they fill out Form W-4 Employees Withholding Certificate.

Here is the most common way to use this word. Marketing IT Human Resources Finance and other administrative personnel who require a high degree of knowledge and work independently qualify as exempt. Tax exempt is when an individual or business is exempt from paying certain taxes.

That being said the IRS maintains very stringent requirements for. Exempt definition to free from an obligation or liability to which others are subject. The way I used it in this episode is not the most typical example so let me give you some common examples and then we can explore how I used it earlier.

These factors may include. The worker must be paid on a salary basis make the minimum salary for exempt employees and have job duties that are considered exempt. Of persons freed from or not subject to an obligation or liability as eg.

In order to be exempt from overtime your company must pay you a minimum salary level. However in some cases you can claim you are exempt from the federal income tax withholding. The reporting of tax-free items may be on a taxpayers individual or business tax return.

Of goods or funds not subject to taxation Familiarity information. Therefore you will not qualify for a tax refund unless you are issued a refundable tax credit. Here are some basic guidelines about exempt.

An exempt employee under California law may be paid on a salary basis without overtime wages without meal and rest periods without certain record-keeping rights and without some of the other legal protections provided to workers who are nonexempt. To be considered exempt from FLSA an employee must be paid on a salary basis and must have exempt job duties. Exempt employees are paid a salary.

Claiming you are tax exempt on Form W-4 tells the Internal Revenue Service that you are exempt from federal withholding. When you file exempt with your employer however this means that you will not make any tax payments whatsoever throughout the tax year.

What Does Exempt Mean Myenglshteacher Eu

What Does Exempt Mean Myenglshteacher Eu

Exempt Vs Non Exempt Legal Definition Employer Rules Exceptions

Exempt Vs Non Exempt Legal Definition Employer Rules Exceptions

Exempt Mileage On Title Cheaper Than Retail Price Buy Clothing Accessories And Lifestyle Products For Women Men

Exempt Mileage On Title Cheaper Than Retail Price Buy Clothing Accessories And Lifestyle Products For Women Men

Levels Of Irb Review Office For The Protection Of Research Subjects Usc

Levels Of Irb Review Office For The Protection Of Research Subjects Usc

Final Exam Exemption For Seniors Only Not Every Teacher Will Be Participating In Exemption Be Sure To Ask Your Teacher S If They Are Allowing Students Ppt Download

Final Exam Exemption For Seniors Only Not Every Teacher Will Be Participating In Exemption Be Sure To Ask Your Teacher S If They Are Allowing Students Ppt Download

Exempt From Withholding Employees Claiming To Be Exempt

Exempt From Withholding Employees Claiming To Be Exempt

When An Exemption Doesn T Apply Reviewing The Exempt Through A Principled Approach To Ethical Review E Sarah Bennett Manager Research Ethics Compliance Ppt Download

When An Exemption Doesn T Apply Reviewing The Exempt Through A Principled Approach To Ethical Review E Sarah Bennett Manager Research Ethics Compliance Ppt Download

Exempt Vs Non Exempt Employees Do You Know The Difference

Exempt Vs Non Exempt Employees Do You Know The Difference

Exempt Definition And Meaning Collins English Dictionary

Exempt Definition And Meaning Collins English Dictionary

I M Exempt What Does That Mean Comstock S Magazine

I M Exempt What Does That Mean Comstock S Magazine

Exempt Versus Non Exempt Employees Paychex

Exempt Versus Non Exempt Employees Paychex

/GettyImages-989124584-3d388da139694016a7c9da74898fb95e.jpg) What Does It Mean To Be Tax Exempt

What Does It Mean To Be Tax Exempt

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.